Be compliant at all times with perpetual KYC refreshes and continuous AML screening.

Constantly updated insights to keep you safe

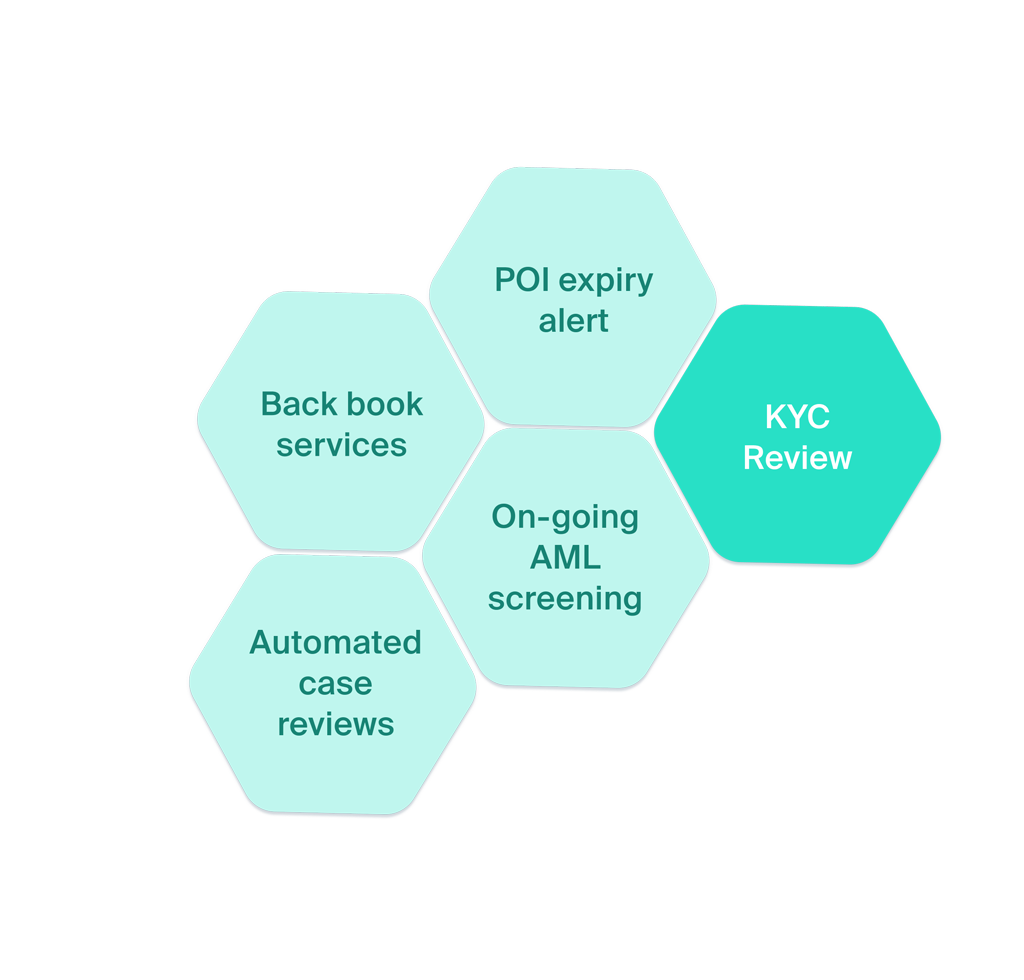

KYC Review keeps customer records truly up to date through automated reviews, continuous KYC and smart monitoring. Let our system ensure the client information you have on file is always accurate, so you don’t have to.

Click on each module to learn more about that specific capability or keep scrolling for a comprehensive overview.

Automated case reviews

Achieve perpetual compliance with anti-money laundering (AML) regulations across multiple jurisdictions. Let our system refresh all KYC and KYB information automatically based on the assigned risk profile of each customer.

Corporate customers’ information is updated automatically by connecting to company registries, downloading the most up-to-date documentation and extracting UBO information. New directors, shareholders and other material changes are flagged to your team for review. If no changes are identified, the case is closed automatically and performed checks are listed in the relevant audit trail for full accountability.

On-going AML screening

Stay safe in the knowledge that all your clients are constantly and automatically monitored for anti-money laundering purposes.

Our platform runs continuous AML screening of all existing corporate and individual customers within the system, including shareholders and beneficial owners. New matches are instantly flagged to the compliance team for review. Every AML-related decision, including false-positive exclusions, are automatically recorded by the system for internal and external auditing purposes.

Back book services

Centralise and standardise all historic customer information and KYC checks to protect your business against hefty fines for years to come.

Our in-house team of data scientists will help you safely import your backlog of customer data directly from your legacy systems into the Know Your Customer platform. Large remediation projects are completed much faster, drastically reducing the need for manual reviews and making your organisation audit-ready at all times.

POI expiry alerts

Having expired Proof of Identity documents on file puts you at risk of anti-money laundering breaches. By relying on our automated triggers and reminders, you can protect your business without having to allocate additional resources to this time-consuming and repetitive task.

When a new customer or beneficial owner is onboarded, the date of expiry of their ID document is recorded within the system. As the date of expiry approaches, our system automatically triggers a request to the customer, asking to provide a new ID document via the branded outreach portal. You can set a specific schedule of reminders and follow-ups for maximum efficiency.

Get in touch

We would love to show you what Know Your Customer can do for your business.

Please contact us to schedule a live demo.