Strengthen your business’s line of defence with the highest quality data in the industry.

All the intel you need to onboard safely

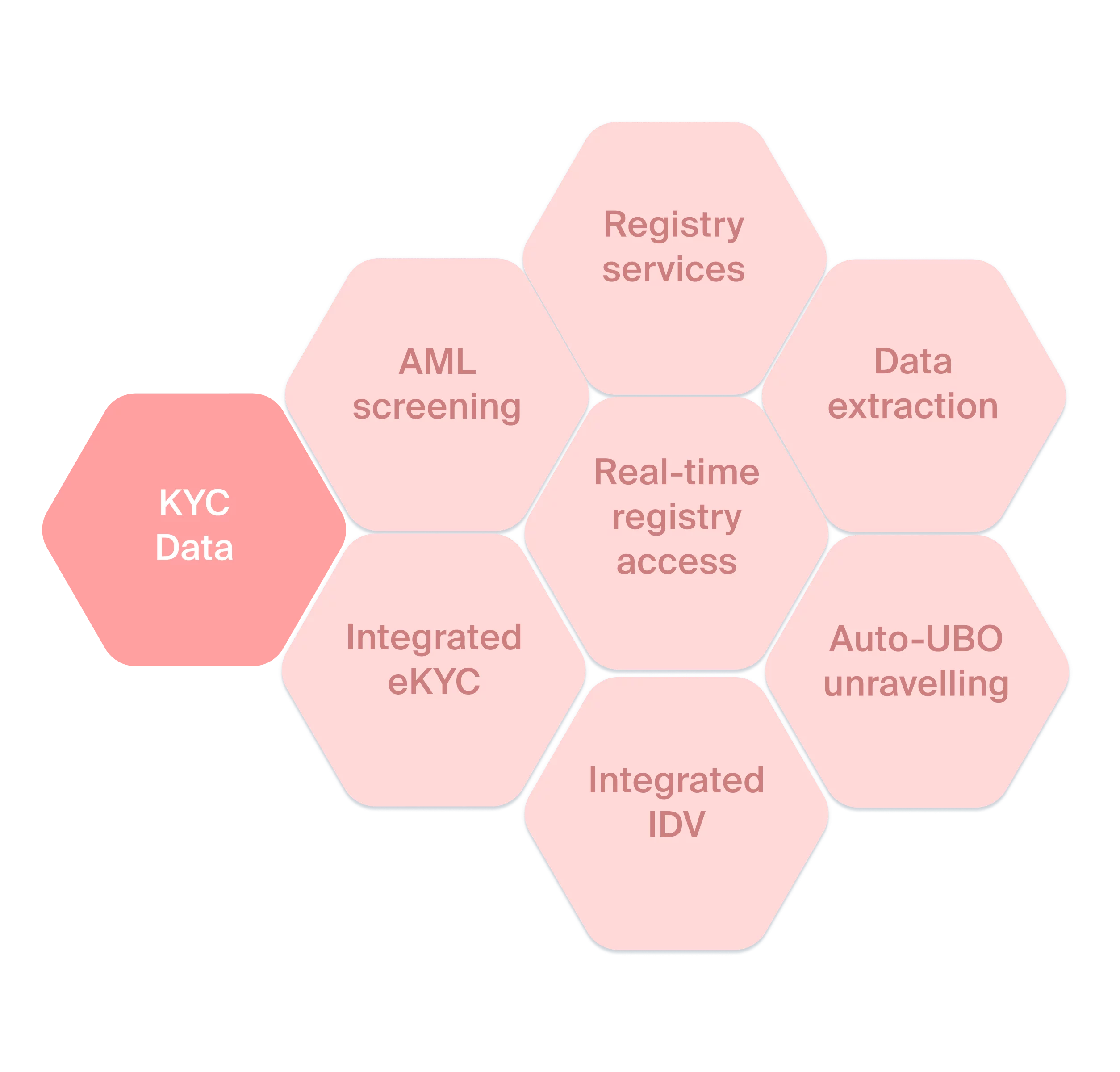

KYC Data equips compliance teams with the most effective tool to protect their business against financial crime and money laundering: unmatched real-time registry access and highest-quality data from authoritative sources, all leveraged through automation.

Click on each module to learn more about that specific capability or keep scrolling for a comprehensive overview.

Real-time registry access

Discover the most powerful and comprehensive real-time registry connector in the market.

Access official company registries in 127 countries around the world via one intuitive interface or a single API. Power cross-border business growth by accessing official registries at the click of a button and without the need for additional local resources. Send your request and let the system do the rest, minimising customer friction and accelerating KYB investigations by 85% or more.

Data extraction

Say goodbye to the challenges, mistakes and delays that arise when transcribing customer information from official documents into internal systems.

Our proprietary technology automates data extraction and validation from registry documents through a unique combination of optical character recognition (OCR), machine learning and natural language processing (NLP). Our system retrieves documents and data from company registries and automatically converts scanned filling documents into structured data – all in real-time.

Auto-UBO unravelling

Investigate corporate structures and identify shareholders faster across jurisdictions with our AI-based UBO engine.

Our system automatically reads and processes information from official registry documents to identify corporate entities’ Ultimate Beneficial Owners (UBOs) and build complex company structure charts across 127 countries globally.

Registry services

Stop wasting time and resources trying to access complex and confusing local registries. Our team of in-house registry experts is always available to support you and source the exact company documents you need to onboard customers safely, providing an extra level of assurance in your line of defence against financial crime.

Need special company documents from one of our 127 registries on an ad hoc basis? Our global Registry Services team will be able to assist you every step of the way.

AML screening

The era of disconnected KYC and AML processes is finally over.

Top AML watchlists are seamlessly integrated within our intuitive user interface, centralising all operations for maximum efficiency. Review potential matches, explore additional information from source links and exclude false positives with a click of a button.

Already have an AML contract in place? You can easily integrate it within your KYC Workspace. Please get in touch to learn more.

Integrated IDV

Instantly validate government-issued IDs, passports and driving licenses from 180+ countries around the world with AI-based verification.

Gain peace of mind about the authenticity of applicants’ identification documents, wherever they are in the world. Prevent fraud and the risk of impersonation with our in-built facial recognition, matching facial comparison and liveness detection capabilities.

Integrated eKYC

Implement simplified due diligence standards and integrate eKYC procedures within your Corporate Onboarding and KYC processes in line with your risk-based approach.

Through our partnerships with leading eKYC providers, you can verify customers’ personal information and true identity against official data sources globally, in full compliance with local requirements.

Get in touch

We would love to show you what Know Your Customer can do for your business.

Please contact us to schedule a live demo.